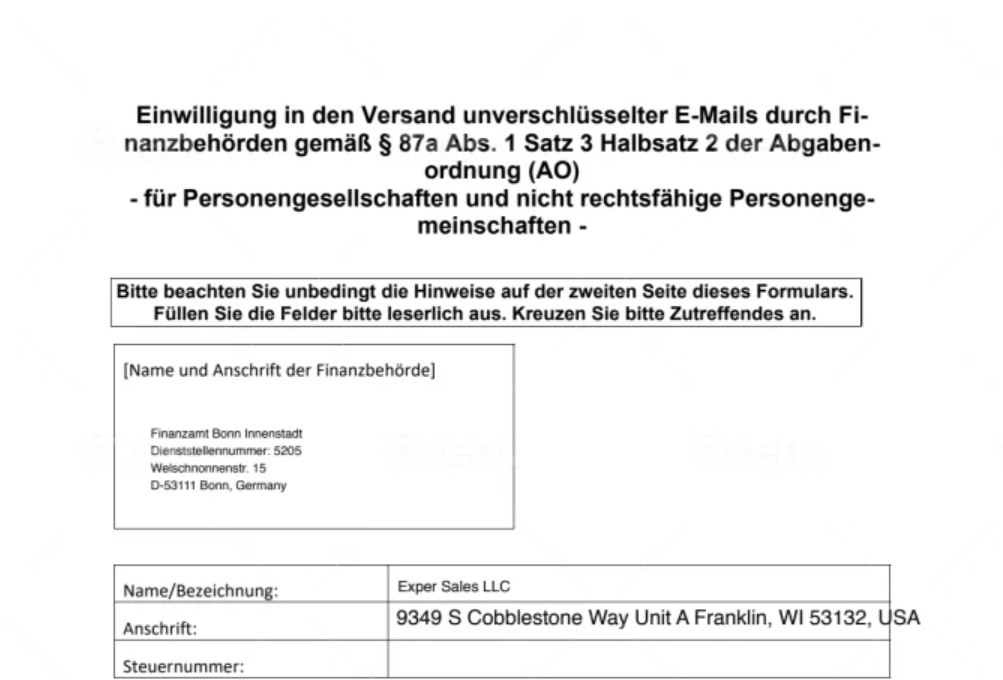

I will apply vat id in germany

Hành động

About This Gig

Based on your business, it is likely that your company will need to be VAT registered in Germany if sales are above the threshold or if stock is held there.

German VAT number

Businesses providing taxable supplies in Germany may be required to apply for a German VAT number. The conditions include:

- Importing into Germany,

- Buying and selling goods within Germany

- Holding live events with ticket sales

- Selling to German consumers over the internet.

Marketplaces are in right to suspend your shop if you don't provide a Vat Number

Most small businesses have to calculate their sales tax payable monthly or quarterly as an input tax return and submit a sales tax return to the tax office.

We manage all the bills you need for your tax matter. We can use software to calculate the amounts to be paid for the relevant period under review and calculate the tax return.

Bạn cũng có thể thích gig này